OK, I’ll admit it. I don’t like numbers or figures or math. I don’t like anything to do with finances (except shopping for pretty things!).

My husband, on the other hand, knows what’s up. Travis is my financial role model. I love how smart he is in general, but especially when it comes to providing for us and saving for our future. He takes care of paying for all our bills, investing our money, saving for emergencies, and he’s even thinking about retirement.

Before I got married, I was pretty good at saving my money and budgeting. But to be honest, retirement was the last thing on my mind. I was in my early 20s for goodness sake. But my husband has taught me how important it can be to start saving for retirement now — even as 26-year-olds.

Today, I’m letting Travis — my financial role model — take over the blog. He’s going to share with you why it’s important to start saving for retirement now, as well as what you need to know about retirement savings.

I know the last thing on most 20-somethings’ mind is retirement. I’m sure the majority of people are too busy worrying about finding a job, starting their career, paying off student loans, and spending money on fun things like traveling! But what you must realize is that now is the best time to start saving for retirement.

It can be difficult to think that far into the future when you are only in your 20s, but the fact is someday you will be at the age of retirement. It is better to prepare now than to end up struggling at an age when you really need savings.

Things To Know About Retirement Savings

Emergency Fund

You should save enough money for an emergency account, which should be able to cover 4-6 months of living expenses. This way you will not have to withdraw money from retirement accounts in financial emergencies and be forced to pay penalties for early withdrawals. Having an emergency savings account is one of the best things you can do and sets you up to start putting money toward retirement.

Compound Interest

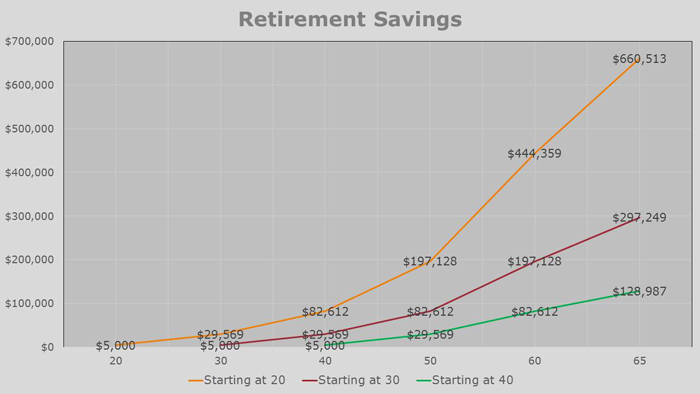

Money stashed away and invested when you are 25 years old will enjoy four decades or more of market gains and compounding interest. That means every $1 invested at age 25 is five times more valuable than $1 invested at age 45.

Compounding interest basically means the interest you make is added to the principal, so the next year you make even more interest because your principal is higher. Waiting to start saving for retirement later in your life could end up costing you hundreds of thousands of dollars. Let me explain using this chart.

If you invest $5,000 when you are 20 years old and put in just $100 per month after that, you would end up with $660,513 by the time you are 65. That is assuming you make 8% interest each year, which is actually slightly lower than the average annualized growth rates of the Dow Jones, S&P 500, and NASDAQ for the past 35 years.

Most people could put $100 per month into their retirement accounts just by making their own coffee at home instead of going to Starbucks or packing their lunch instead of eating out every day.

10% Minimum

Try to save 10% of your income each month toward your retirement account. If that sounds like a lot, then consider this — if you would like to live the same standard of living you do in retirement as you do when you are working, you need to save at least 10% in your 20s.

If you wait until your 30s, that percentage goes up to 20% and 40s it goes to 30%. I understand it might be difficult to do this right away, but I bet everybody can find ways to cut back on spending each month. If you cannot do 10% right away, start out with 5% and every year or every time you receive a raise, up the percentage.

Where to Save

Open a Roth 401(k) or a Roth IRA. A 401(k) is offered by some employers, and a Roth IRA is an Individual Retirement Account. Roth accounts are funded with after-tax dollars, but it allows you to pull out income tax-free in retirement. This means you pay income tax on all contributions, but you don’t have to pay any tax on withdrawals.

There are also Traditional 401(k)s and IRAs, which offer tax deferred savings, meaning you don’t have to pay any income tax on contributions made now. But you will pay tax on all withdrawals in retirement. Personally, I recommend using Roth accounts when you are in your 20s rather than traditional, because you won’t have to pay as much in taxes in the long run.

Let’s use the chart above as an example. To simplify this while explaining, we’re going to pretend there is a flat 10% annual tax rate. Taxes are more complicated than that, but let’s go with it so I can explain better. If you fund a traditional IRA and save $100 per month, that is only a $120 tax savings per month. But when you retire, if you would withdrawal just $40,000 a year, you would be paying $4,000 a year in taxes. However, if you fund a Roth IRA and save $100 per month, you are paying $120 in taxes per year, but when you retire you wouldn’t have to pay any taxes for withdrawing.

Roth IRA

So what is a Roth IRA? It usually is a combination of domestic stocks, foreign stocks, and bonds. Investing your money may be intimidating, but with a Roth IRA fund managers do the work for you. It is their job to grow and protect your money.

One of the benefits of starting a retirement account in your 20s is you can own a more aggressive account, which means there is a higher percentage of your money in stocks. The bigger the risk, the bigger the reward. There is a possibility that you could lose money, but you are so young that if you lose money you should earn it back plus some.

No matter what, be sure to talk to your own financial adviser about what would be best for you.